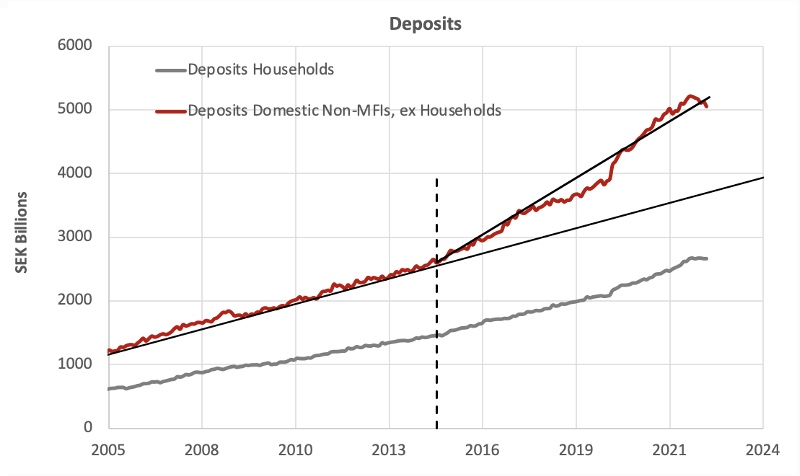

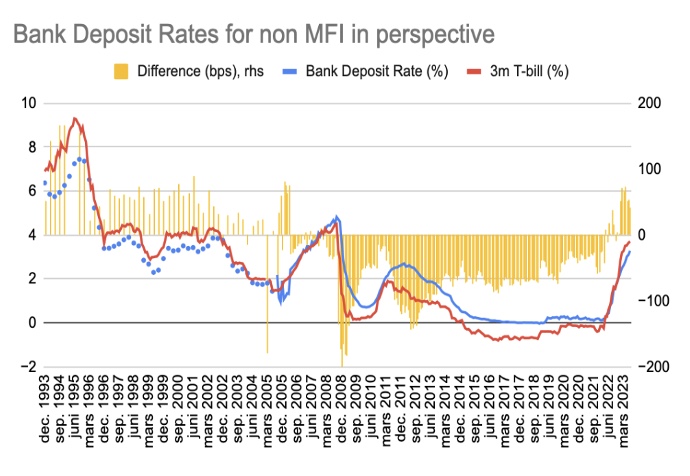

Since 2015, the year when the “risk-free rate” (illustrated by a 3m T-bill) in Sweden became negative, corporate deposits have grown at a faster pace than the historical trend – very intuitive as you receive a better return.

However, with a normalization of policy rates, AAA-rated Swedish T-bills once again offer a better return than savings accounts on most banks. To us, it suggests i) there is plenty of excess cash that might find its way back to the Fixed Income Money Market, ii) Corporate Treasuries have a lot of money to “save” by being active with their liquidity, iii) there are ample of investment opportunities for those with the tools and balance sheet to take advantage of it.