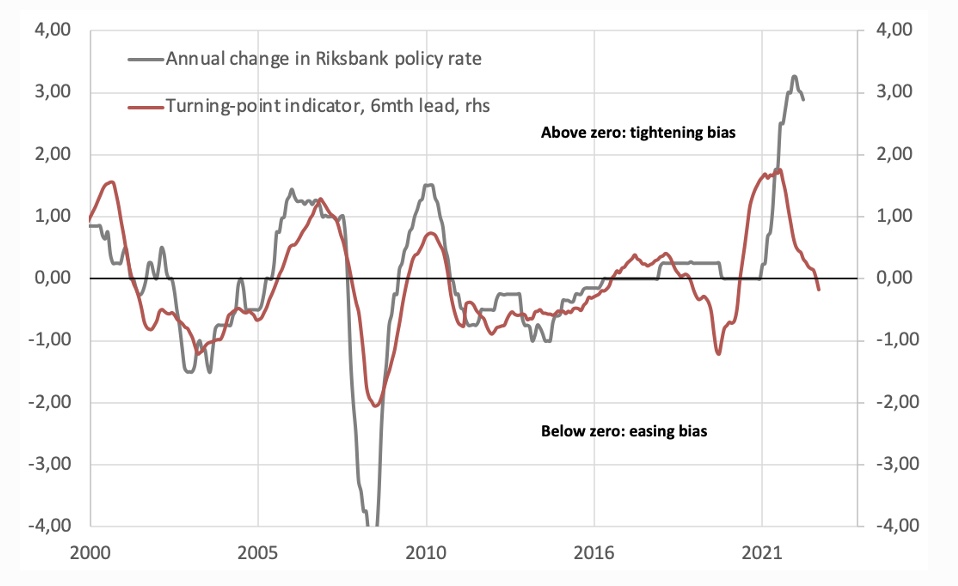

Monetary Policy is complex but on a directional basis, the overall picture can be captured in a non-complex way by studying developments in key macro variables. By normalizing a selection of publicly available data, it is possible to get a fairly good proxy on if monetary policy is in, or approaching tightening or easing mode. This way of gauging the policy path has served well during the past two decades and through various types of cycles. As the chart should serve to illustrate, the policy rate is biased to be lifted as the turning-point indicator is above zero, and vice versa. Currently, the indicator suggests that the end game is nearing in Sweden and for the Riksbank. Yet another convincing argument for enhanced fixed income exposure.