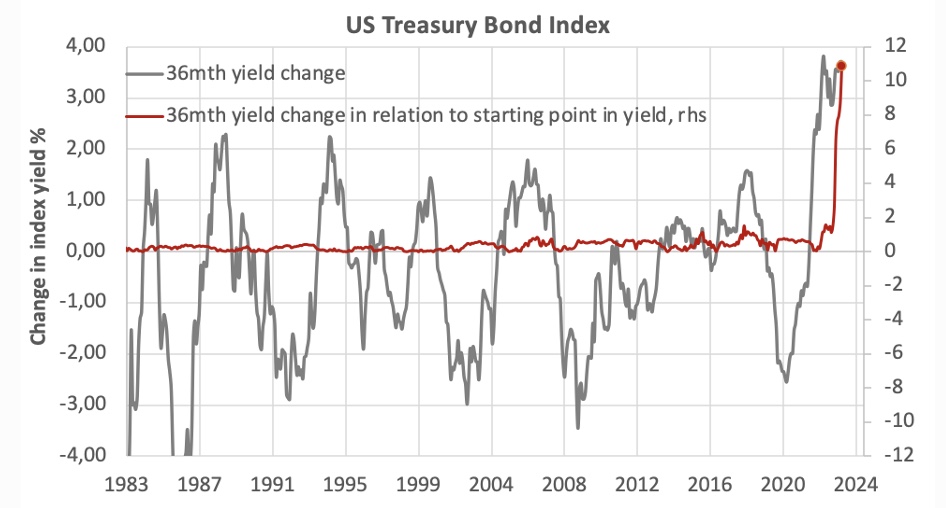

There are several ways to look at the longest streak, and greatest set-back, in AAA bond returns over more than 50 years. Yes, the rise in yield has been very large, but it is predominantly the rise, in relation to the starting level of yields, that is the unprecedented number. The average US Treasury bond index was at around 0.40% (and duration 7,5 years) when the move higher began, effectively implying there was only downside left. Such yield level is not providing much of a cushion or comfort when yields rise and definitely not when they rise over 11 times the starting point. No surprise that correlation with equities rose, and diversification benefits vanished, as risk assets were highly sensitive to sharply higher rates also. Looking ahead, a cushion is yet again being built up in yield curves and the set-back witnessed can likely only repeat itself in a down-grade credit event.