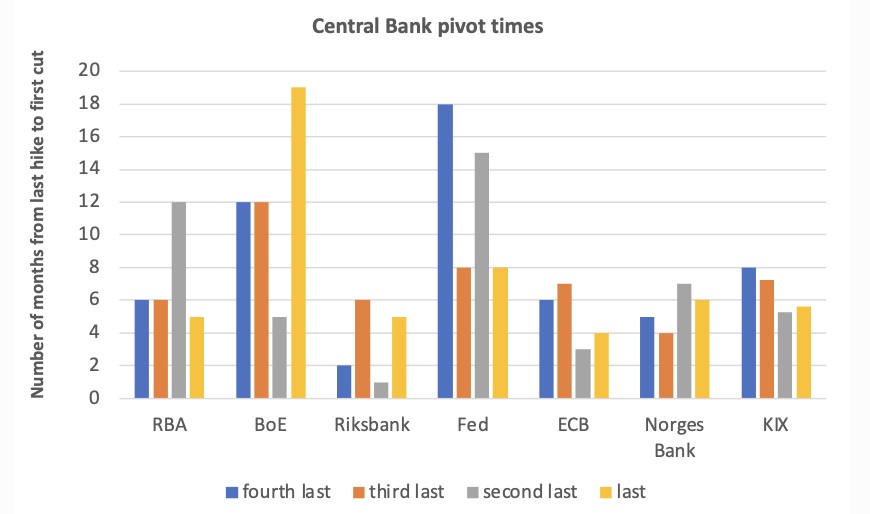

Riksbank joined the central bank pause camp on 23 Nov, although they still acknowledge there is some bias left for another move higher. Market speculation, however, is all about the timing for a first cut. By looking at the previous four rate peak occasions among major KIX central banks, it has on average taken around 7 months from the peak-point to the first rate cut. Assuming the peak is here now, a first cut from a simplified historical perspective, should then be priced in some time around April – May 2024 (or earlier, since Riksbank has been notably quicker to cut than its peers). That seems quite unlikely though, if not inflation drops surprisingly sharply and/or the labor market deteriorates markedly. Time will tell, but value in bonds are undoubtedly still to be found in shorter maturities, rather than longer maturities.