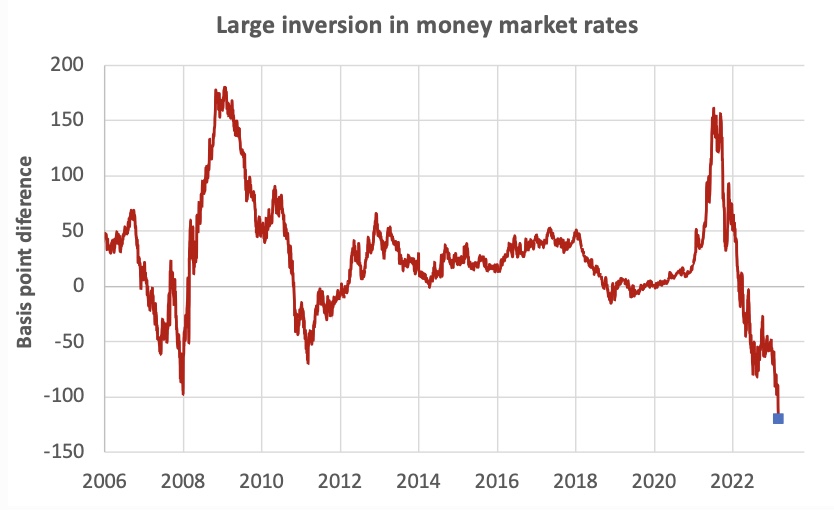

The re-pricing of future central bank policy globally has been massive recently and the narrative ”higher-for-longer” ended up in the trash fast. Sweden and Riksbank policy is of course not immune, and currently some 1.25% worth of cuts are now discounted in 2024. Thus, bonds have performed a lot recently and with the policy rate at 4.00%, the front-end of the yield curve has flattened and inverted to historical extremes (see chart).

One thing is clear, the current pricing is hardly compatible with the narrative ”soft landing”. Rather, this type of pricing and curve inversion is compatible with tough times and a ”hard landing”. Basically, if inflation is not dropping sharply and distinctly below target, a continuation of contracting GDP and a deteriorating labor market will be necessary in order to motivate such magnitude of policy reversal. Not impossible, but the market has squeezed a lot of value out of 2024 already!