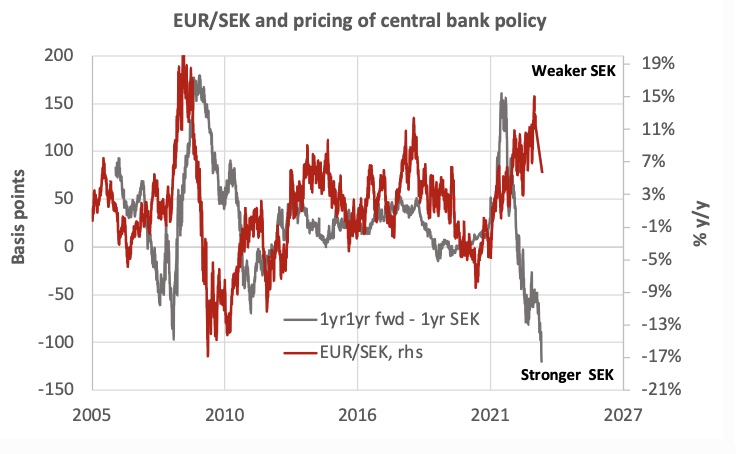

The Swedish currency (SEK) has had a terrible couple of years, depreciating in trend to historically weak levels. The weakening comes from multiple risk sources of which one is domestic risks stemming from sharply higher rates in combination with a high debt burden in the real estate and household sector. However, very quickly, the higher-for-longer scenario for policy rates has been re-priced, which is an argument to believe some relief is on the cards here.

In addition, assuming that forward pricing is broadly correct, it is probable that ECB will ease policy before the Riksbank. Not least as inflation in Sweden is notably hotter compared with most European countries. The combination of these factors suggest the SEK may be up for additional strenght, something we have witnessed in the past with significant curve inversion.