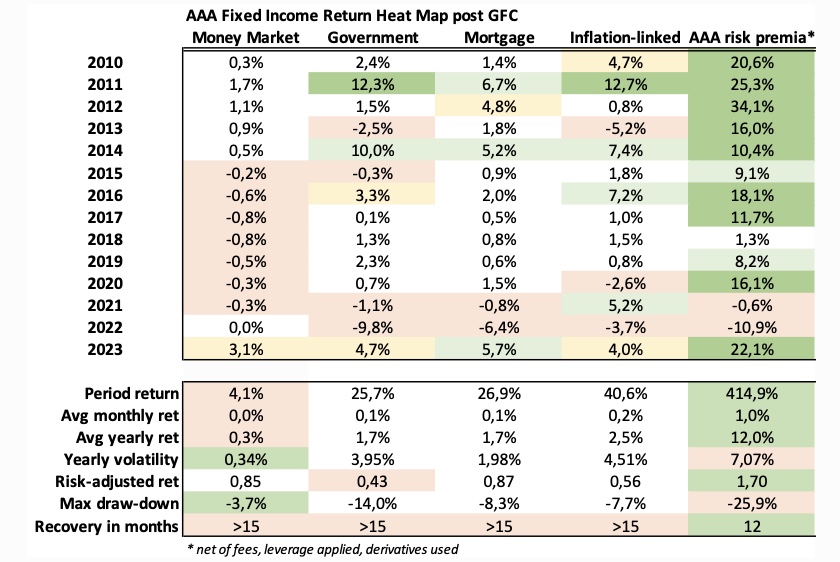

As highlighted before, the draw-down in global AAA markets was unprecedented in 2022, following the sharp acceleration in inflation and accompanying response by central banks. Last year was set for recovery, and positive returns was realized across the Nordic AAA universe. The risk & return metrics since GFC is an interesting watch. There are multiple reflections to be made, but especially the risk premia strategy, which yet again has been dominant in terms of taking back lost grounds quickly. High-water mark was reached after just 12 months, following the greatest fixed income crisis in modern times, while there is still 8% left in long only strategies with longer duration. Looking beyond outsized realized returns, the ability to recover fast is a core principle in this AAA risk premia strategy.