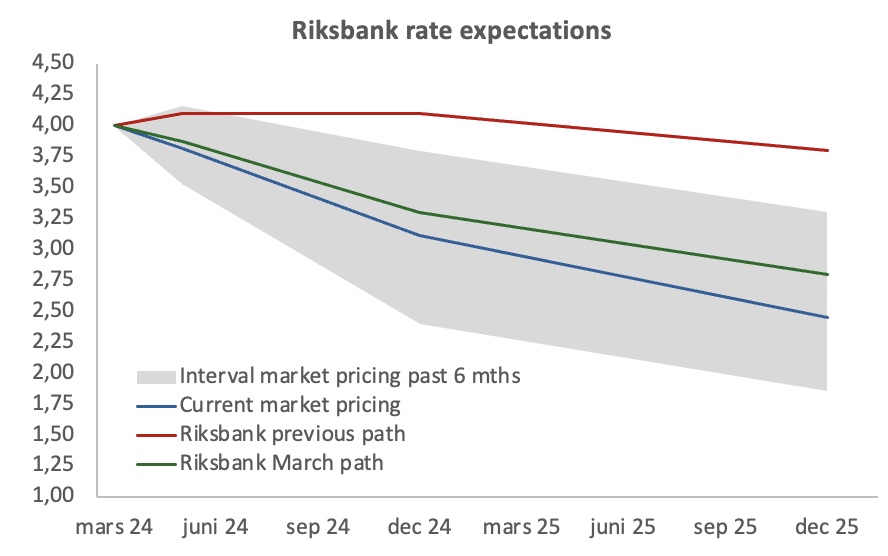

Today, substantial confirmation was received, that the Riksbank is now broadly aligned with the “getting ahead of itself” discounting that has taken place during the past six months in markets. By looking at the rate path, it looks like one full 0.25% rate by June is as close to a done deal as it could get, with an even 50% likelihood on the forthcoming May and June meetings, respectively.

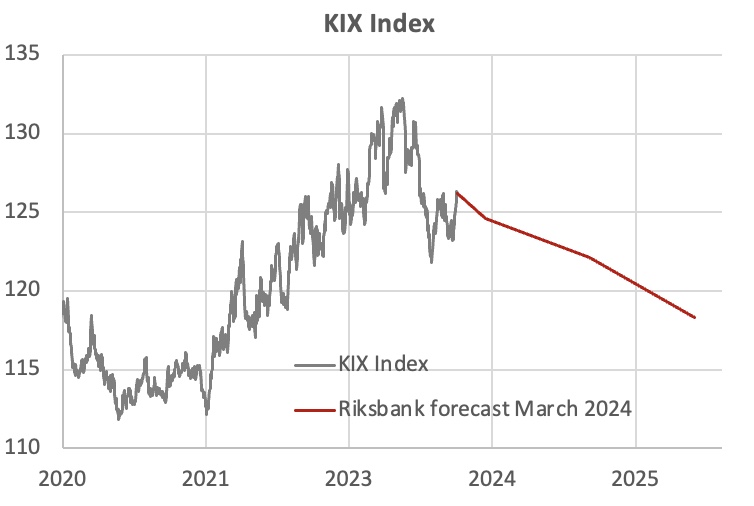

All-else-equal, the message is likely to reduce volatility for a while, which normally is good news for fixed income risk premia strategies and credit exposure. To single out domestic news with the ability to rock the boat, inflation is certainly on top, although there will be limited further information at the central bank drawing-board ahead of the May meeting, with only one release in between now and then (on 12th April). In terms of timing between May and June, attention will likely also fall on the currency, which is expected to appreciate in KIX-terms over the course of the forecast horizon.