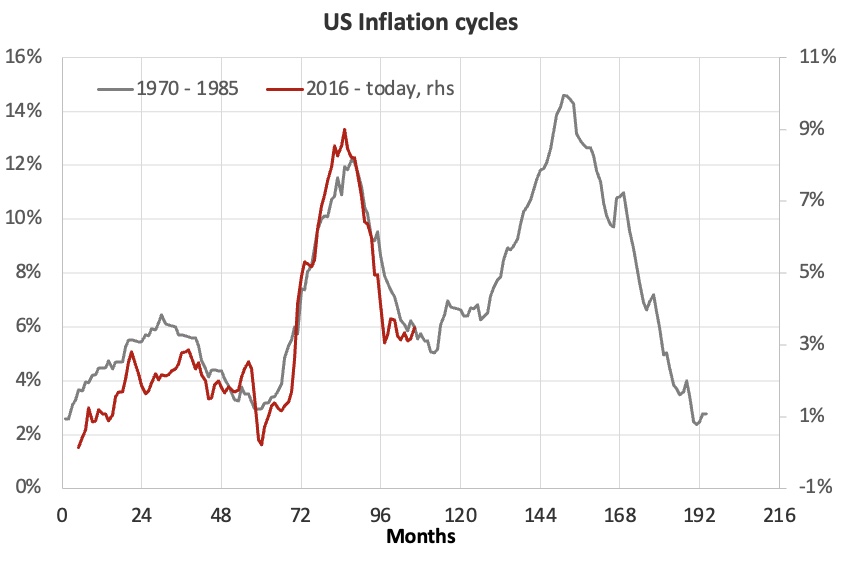

Fed rate cut expectations has been priced out quite a lot recently, mainly following hotter than expected inflation, in combination with multiple leading indicators pointing to stickiness and re-acceleration. In addition, hawkish tones by Fed speakers have indeed also contributed, with statements such as “now see Fed cutting later than previously thought”, “reason to think rates will stay higher for longer” and “no urgency to cut interest rates”. In the wake of it all, views have emerged that the next rate move could be a hike, not a cut, with pattern-charts like the one below being frequented.

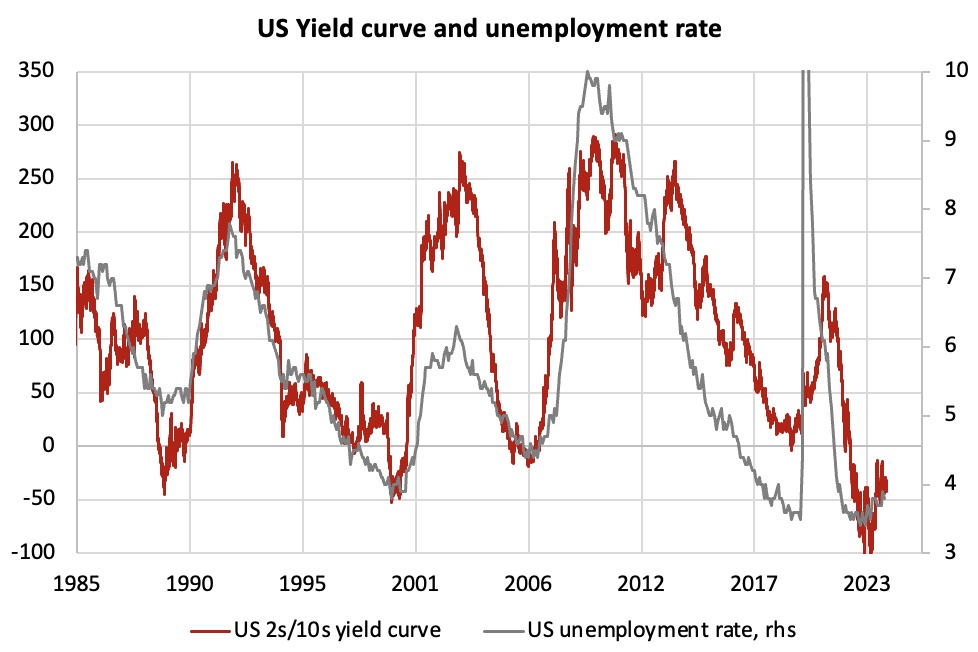

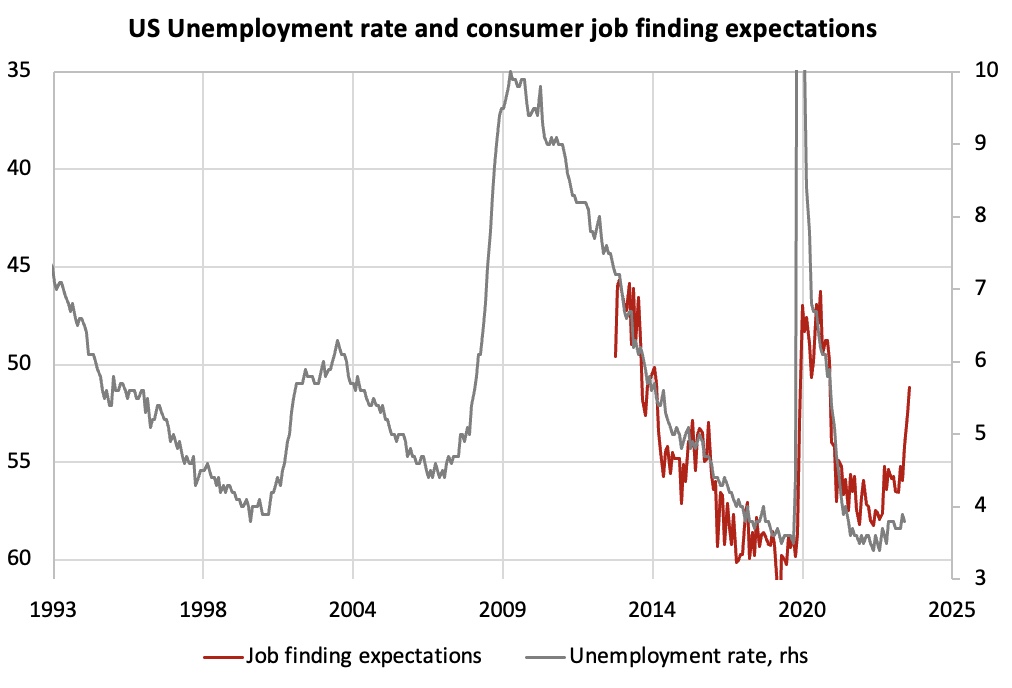

Rightly, the risk sentiment has been shaken, with dollar strength and bond sell-off in slight bear steepening fashion. From here, as a balancing act, the development in the US labor market will be important. There is a strong logic behind the labor market and the yield curve (through monetary policy), and several soft indicators suggest that a bit of labor market deterioration could be on the cards.

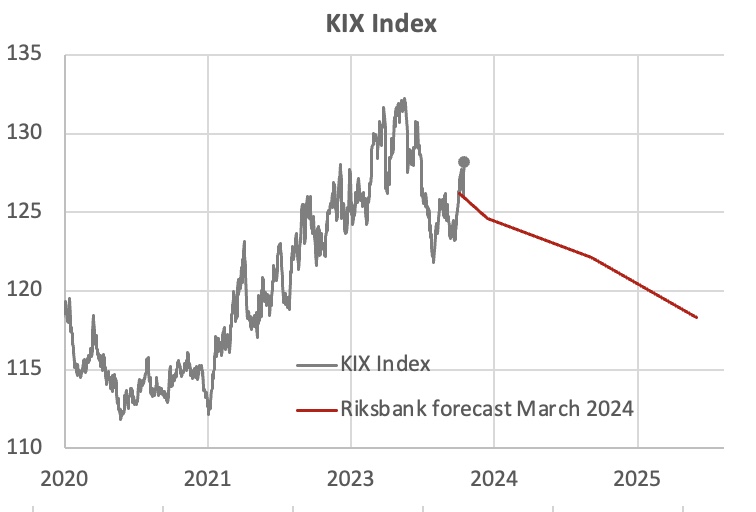

Meanwhile in Sweden, the consensus is for a first rate cut in May, which is also largely priced in. Such contrasting view comes mainly from the recent inflation print, that was softer than anticipated. As an effect, though, the combination of such expectations, the dollar strength and the weaker risk sentiment, has pushed the SEK weaker yet again. Interesting times ahead..!