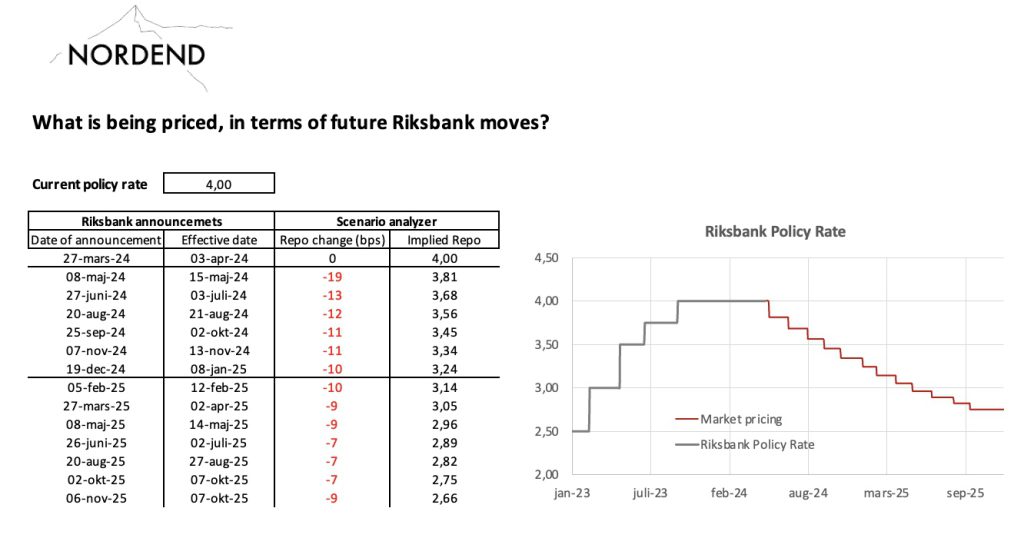

The Riksbank is announcing rates this week, on 8 May, and its widely expected by economists and markets that a first cut is on the cards. According to markets, around 75% of a 0.25% cut is discounted for this meeting. The policy rate is then expected to reach 3,24% by the end of 2024 (0,85% above the lows six months ago).

Reach out on info@nordend.se to get you own copy of the market pricing calculator!

As growth is still weak (although troughing), inflation has surprised on the downside (with further downside in play) and the labor market showing signs of accelerated weakness, the main obstacle against a rate cut at this juncture is likely linked to being the first to shave. Or more specifically, the risk of inducing further weakness to an already weak SEK (with potentially higher imported inflation further down the road).

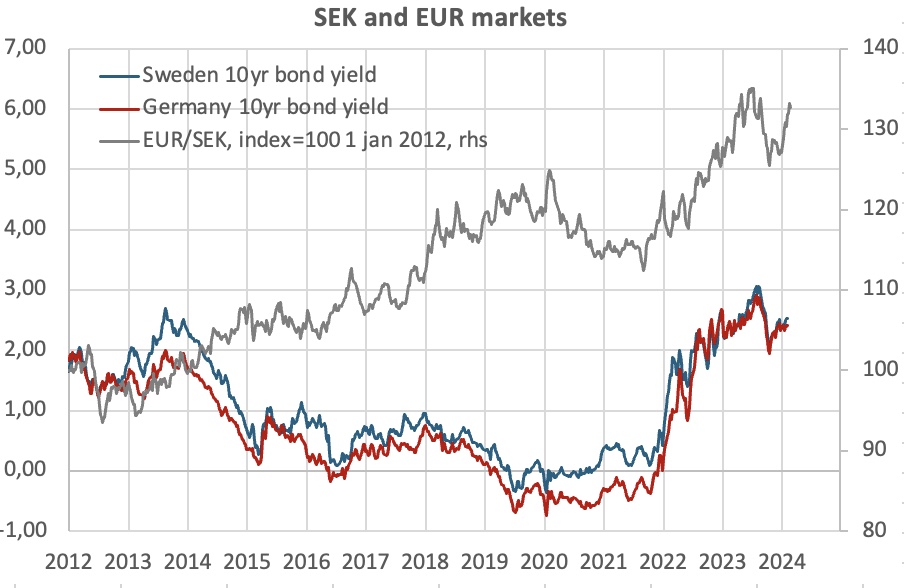

As a matter of fact, the SEK has depreciated in a steady trend for a long while and is currently more than 30% weaker versus the EUR since the beginning of 2012. A trend that for example cannot be explained by a corresponding move in interest rate differentials.

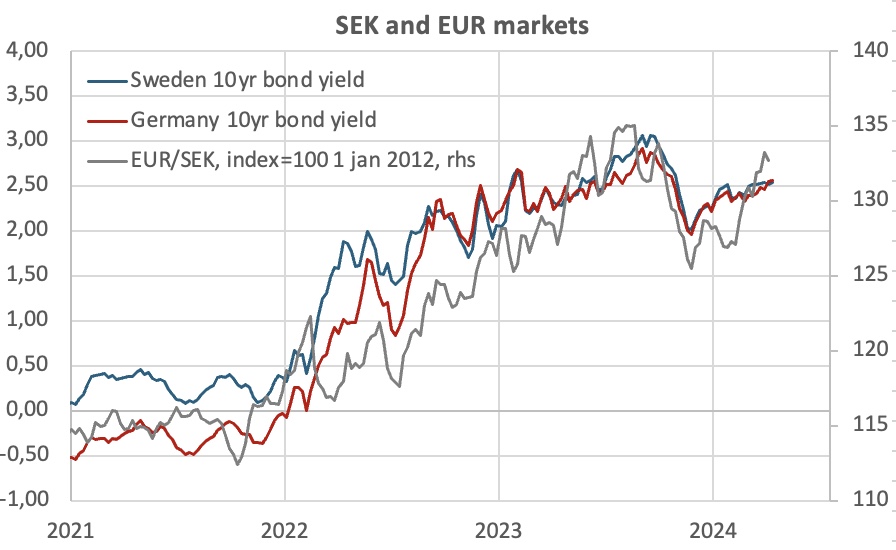

Most of the weakness, however, has come alongside the major sell-off in rates, which began in the autumn 2021. Since then, the SEK weakness has been highly correlated to the ups and downs in European and US yields. That leads into the suggestion that the weakening comes from the risk side of things, i.e. that higher rates are envisaged to be a more sensitive thing to the Swedish economy, with a debt heavy private and real estate sector. If that suggestion is correct, being “the first to shave” may actually stop, or even reverse, the SEK weakness.