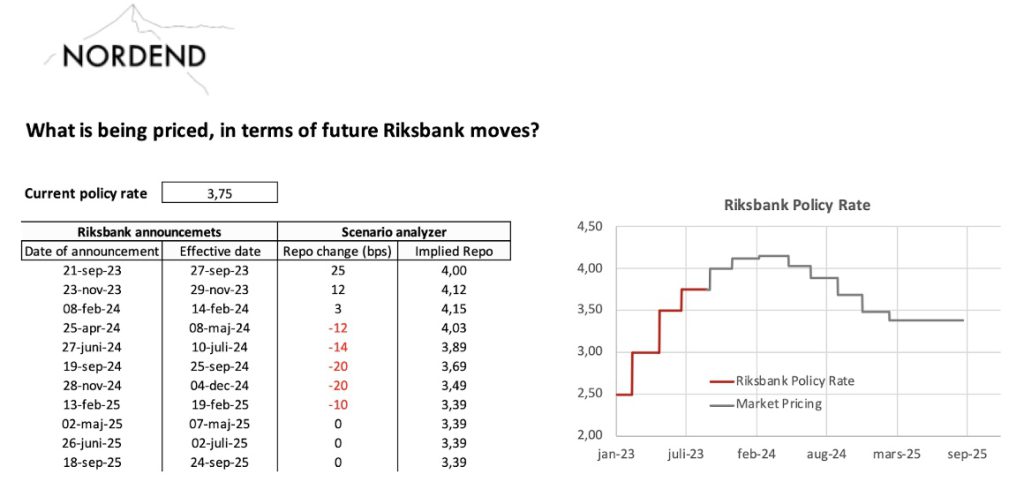

On 21 September, the Riksbank is widely expected to hike rates by 0.25%, to 4.00%. Fixed income analysts, bank economists, market makers and bond portfolio managers all have perfect insight into not only what is being priced in for this particular meeting, but also for the years to come. That insight is valuable information for everyone analyzing and managing assets and indeed those managing debt.

It is not difficult to grasp it, but not standard routine either, as it requires some special knowledge around the technique, choice of instruments, conventions, price sources, calculation method and a few more things. For those interested to figure it out on your own, reach out and we share our Excel Sheet.