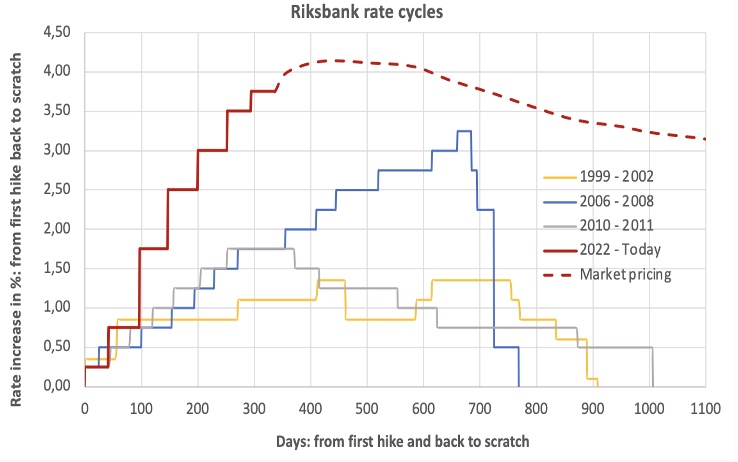

The ongoing hiking cycle is unique in many aspects; the starting point was zero, after several years with negative rates and QE, and the market was comfortably convinced that rate hikes were unlikely or if not, very limited in scope. Some 1,5 years into the cycle we can conclude: (i) that the pace and magnitude is more than twice as aggressive as in previous cycles, (ii) there is another 40 bps worth of hikes priced in and (iii) the market price in a “higher-for-longer scenario” for the years to come, something that has not occurred in the past.

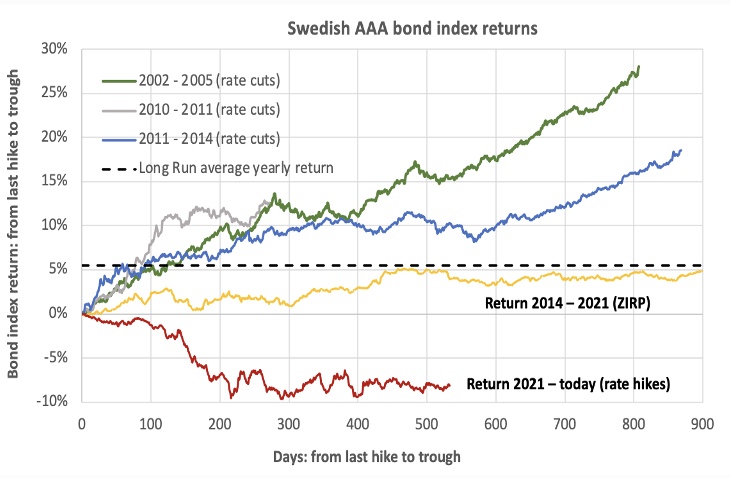

Swedish AAA bond index returned poorly during the 2014 – 2021 period when rates were at or below zero. Then, in the adjustment phase higher, returns got horrible. The outlook ahead ought to be brighter with yielding assets and a great potential should a rate cutting cycle replace the higher-for-longer scenario at some point.