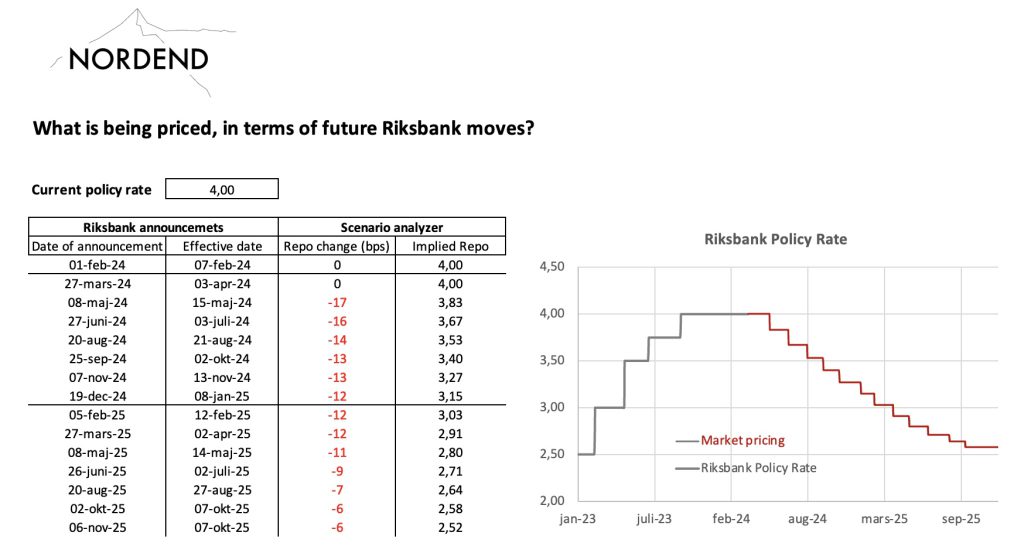

The market pricing of a rate move at the Riksbank meeting next week has moved little during the past six months, while the May meeting (for some reason) has been the main speculative target among market participants and forecasters. There is effectively 0% probability of a rate change priced on 27 March, while there is a distinct 68% chance of a 25bp cut priced at the forthcoming meeting on 8 May.

Looking at key data since the previous meeting in February, we think it’s fair to assume that the inflation profile looks likely to be revised a bit lower, while the opposite seems reasonable for GDP growth. Perhaps it will translate into some bias in the rate path for a rate cut at the meeting in May, but no point really, at this juncture, to signal a higher likelihood than 20 – 30% given that (i) inflation has yet to drop to more comfortable levels, (ii) uncertainty is still there on ECB, although they seem likely to move in June, (iii) unnecessary to give a firmer hint just yet, and risk to weaken the currency, and (iv) such a signal would be enough for markets to keep the accumulated pricing for the next couple of meetings.

All-in-all, the first cut is the deepest, but also very difficult to call. It is much easier to have an opinion on the road ahead after the turning point, since there is typically a high degree of autocorrelation in both macro data and monetary policy, i.e when the trend has turned, the new trend normally holds for a considerable amount of time.

For a deeper dive on the importance of trends, and the state of the nation at previous Riksbank easing cycles, have a look at our previous comment “Mostly speculation, so far”. Furthermore, in case you want to get a copy of our Riksbank pricer (Excel) just reach out on info@nordend.se